Solana chain data exploded in November: Phantom entered the Apple Store download list, and MEME coin PVP difficulty increased

Author: Frank, PANews

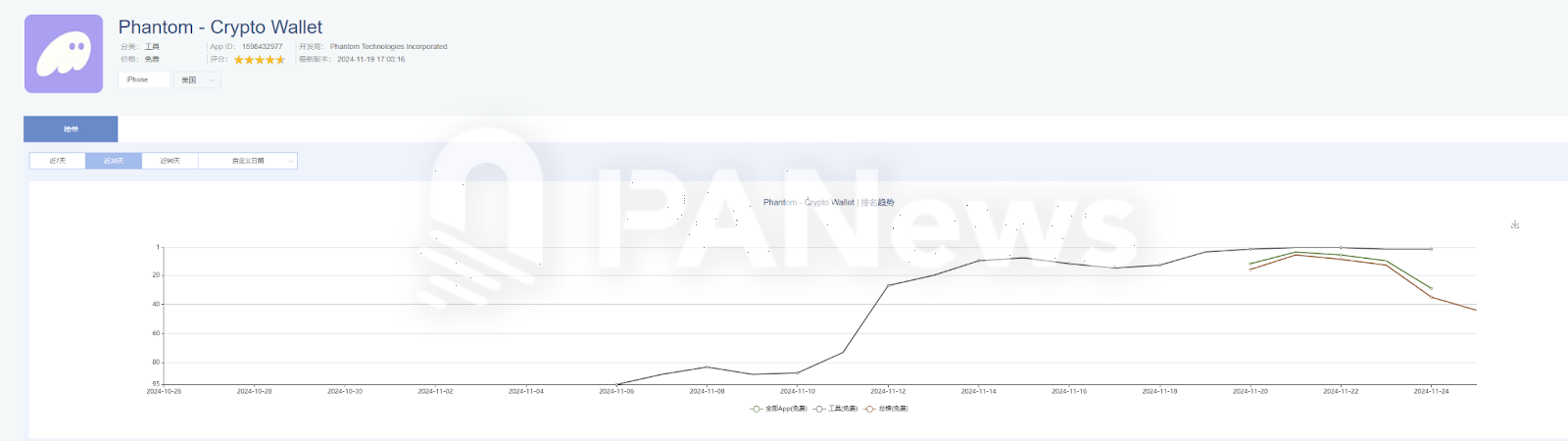

On November 21, Solana Ecosystem Crypto Wallet Phantom ranked fifth in the free app rankings of Apple App Store in the US region. It ranked first in the subdivided tool category. This should be the best performance of crypto native applications in the mainstream application market. The reason behind this is the recent data explosion on the Solana chain.

Is the crypto world entering a truly active period? What more meaningful facts are hidden behind the active data on the Solana chain? PANews conducted an in-depth analysis of Solana's on-chain performance.

Solana on-chain data doubled in November

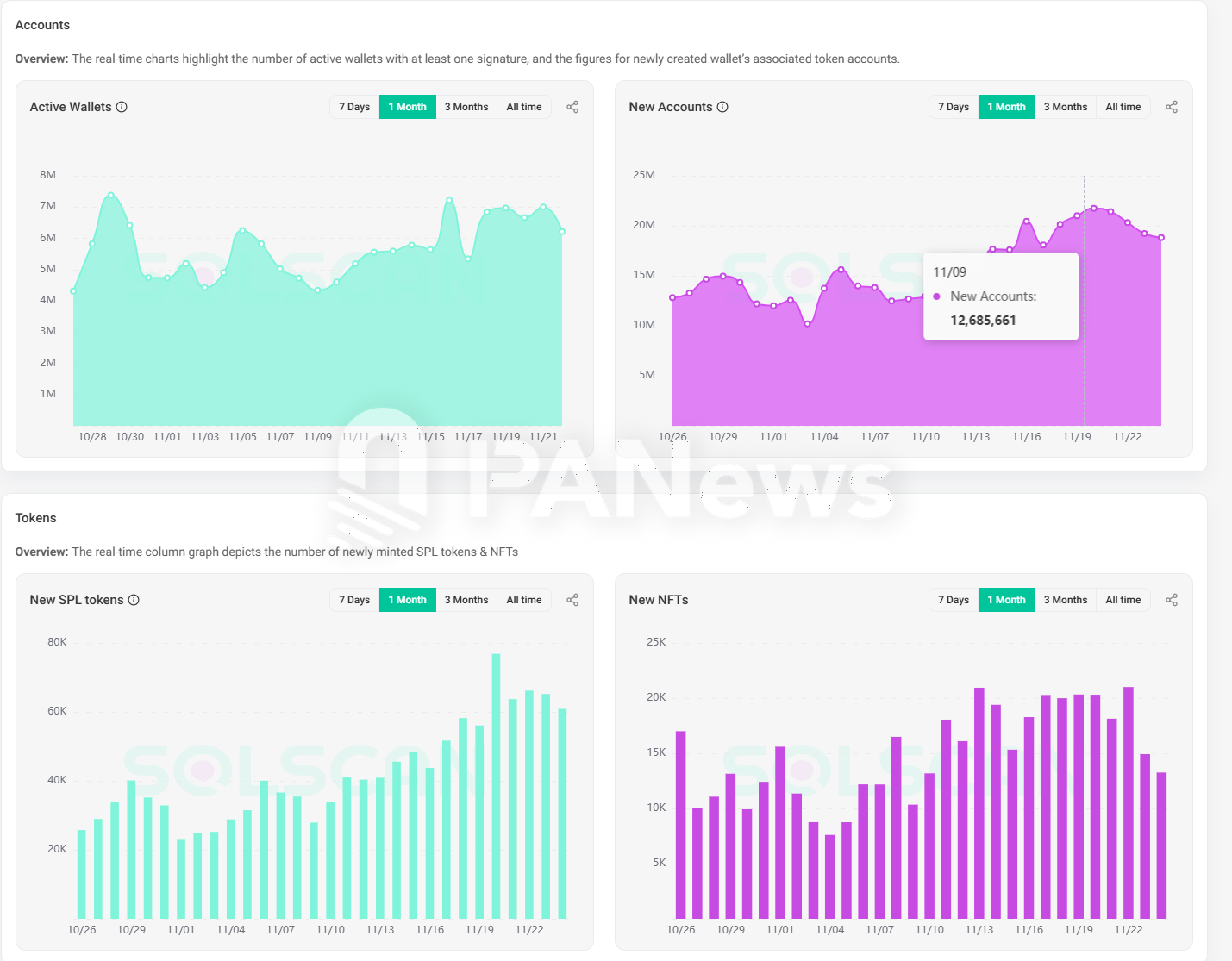

First, let’s review the recent amazing performance of Solana chain. On November 9, Solana’s active wallet data was 4.33 million, and by November 21, it reached 7 million active wallet addresses. On October 5, the data was only 893,000, and this data increased nearly 8 times in more than a month. On November 3, the number of new accounts was 10.19 million. By November 20, the number of new accounts reached 21.75 million, and the number of new accounts increased by more than 1 times.

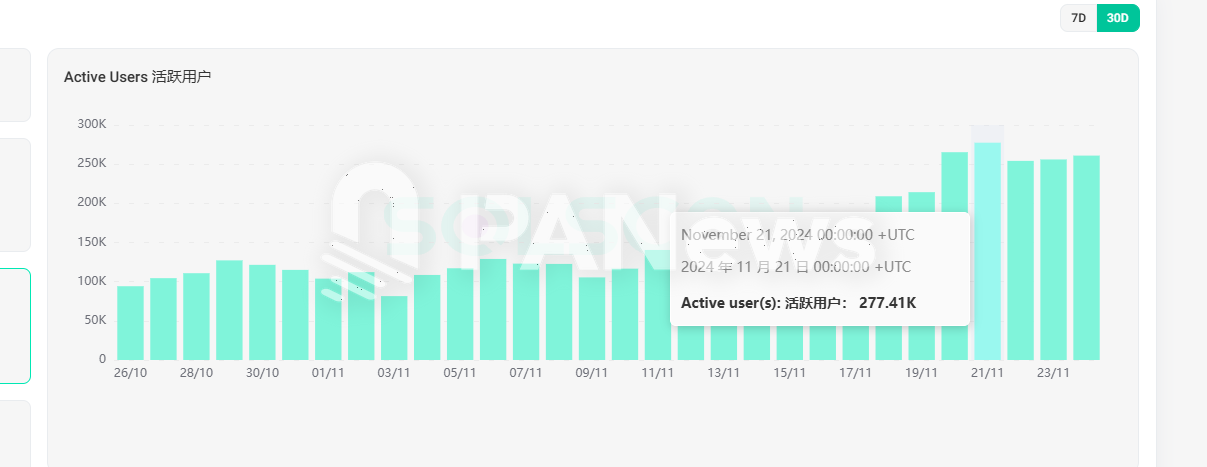

The biggest boost during this period came mainly from MEME coins. Pump.fun's data performed particularly well. Data from November 2 showed that Pump.fun's app interactions were 130 million times, and by November 20, it had reached a peak of 489 million, an increase of nearly 4 times. In terms of the number of 24-hour active users, it was 81,500 on November 3 and reached a peak of 277,000 on November 21, a surge of more than 3 times. The total transaction volume was also the same, with 1.82 million transactions on November 3 and 4.82 million transactions on November 22.

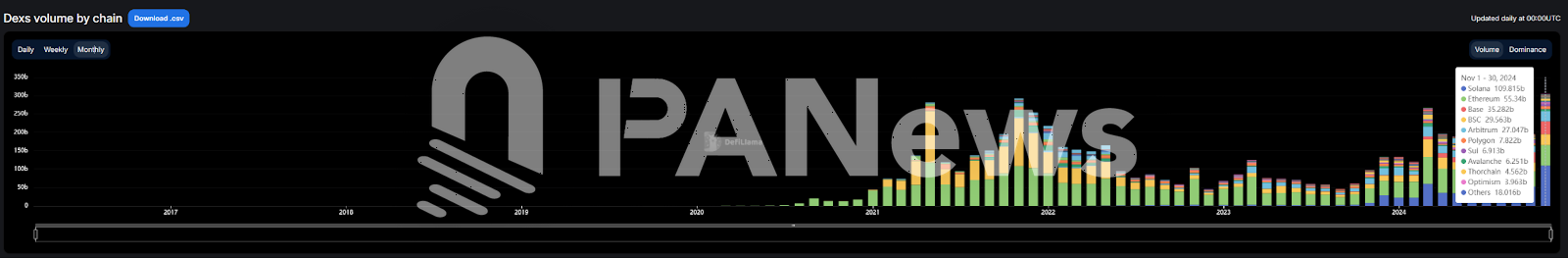

The active users have led to a significant increase in transaction volume. According to Deflama data, the transaction volume of the Solana network’s decentralized exchange (DEX) exceeded $100 billion for the first time in November, reaching $109.8 billion. This figure is close to twice the monthly DEX transaction volume of the Ethereum main network ($55 billion), an increase of more than 100% compared to $52.5 billion in October.

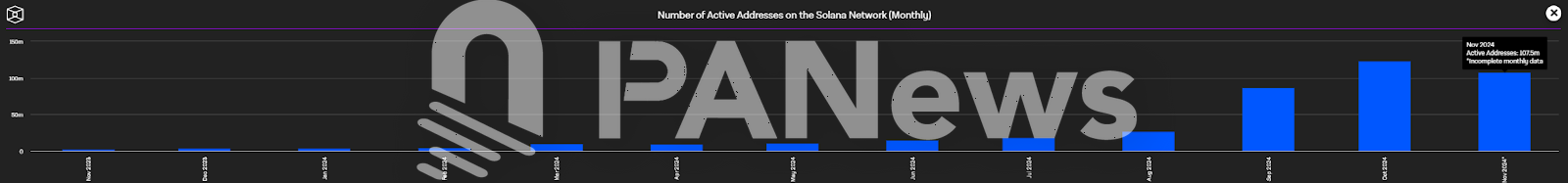

Solana currently has 107.5 million monthly active addresses, and is expected to break the record of 123 million set in October by the end of the month. The SOL token recently broke through the 2021 historical high, reaching $264.

MEME is active, but PVP is more difficult

Let’s take a look at the daily average number of active addresses.

Before describing the specific data, we need to explain Solana's new account mechanism. The number of new account addresses here is not the number of active addresses described in conventional blockchain browsers, but the number of all new token addresses on the Solana chain. For example, a user address may buy multiple tokens, and each time a new token is bought, a new account address will be created. Therefore, the number of new account addresses is much higher than the number of active wallet addresses.

Compare the data from November 1 and November 20. On November 1, the number of active addresses was 4.74 million, and the number of new account addresses on that day was 12 million. On average, each active address created 2.53 new token addresses on that day.

As of November 20, the number of active wallets was 6.66 million, the number of new accounts was 21.75 million, and each active wallet bought 3.26 new tokens on average. From this data, we can see that not only has the overall data ushered in a huge growth, but users' trading enthusiasm has also been greatly boosted.

But for players who are hot on MEME, is the surge in data on the chain an increase in opportunities or a decrease in probability? How many people hold the tokens every day? On November 1, the number of newly generated SPL tokens was 22,908, the number of new accounts on that day was 12 million, and the average number of new addresses allocated to each new token was 524. By November 20, the number of new SPL tokens was 76,838, the number of new account addresses on that day was 21.74 million, and the average number of new accounts allocated to each SPL was 283. This also shows that although the overall popularity on the chain is increasing, it seems to have caused a more involuted PVP phenomenon, and the speed of issuing coins far exceeds the speed of new users entering the market.

Men born in the 1990s and 2000s are the main force on the Solana chain

The application that has benefited the most on the Solana chain is the Phantom wallet. On November 21, the Phantom wallet ranked sixth in the overall ranking and first in the tool category in the Apple App Store. Before November 6, Phantom did not even have any ranking data. Within half a month, it jumped from 95th in the tool list to first.

According to data from similarweb, from the perspective of user data analysis, the countries with the largest growth in Phantom in recent times are Brazil and the United States. The traffic from the United States reached 27.38%, an increase of 24.82% in the past month. Although the proportion of Brazil is not high, at 2.97%, the growth rate is 70.17%. The top five countries are: the United States, the United Kingdom, Russia, Brazil, and Pakistan.

Phantom's audience is 70.5% male and 29.5% female. The largest age group of visitors is 25-34 years old, accounting for 41.76%, and users aged 18 to 24 account for 20%. From this data, it can be seen that the main players of MEME on the chain are concentrated in the post-90s and post-00s, and this age group accounts for more than 60%.

Sui is the only public chain that keeps up with Solana’s data growth

Is this data explosion limited to Solana or is it a collective explosion across the entire network?

Judging from the growth data of the App Store, most crypto apps have seen growth. In addition to Phantom, Coinbase's recent ranking has also risen to 29th in the overall ranking and first in the financial ranking. Others such as Solflare, DEX Screener, MetaMask, and Crypto.com have all grown to varying degrees and entered the top of the data rankings.

Looking at the on-chain data, Ethereum has also seen an improvement since November, but the increase is not obvious. The number of active Ethereum addresses was 437,000 on November 6, and reached a peak of 545,000 on November 22, an increase of about 24.7%. Other data also increased slightly, but it is not a blowout.

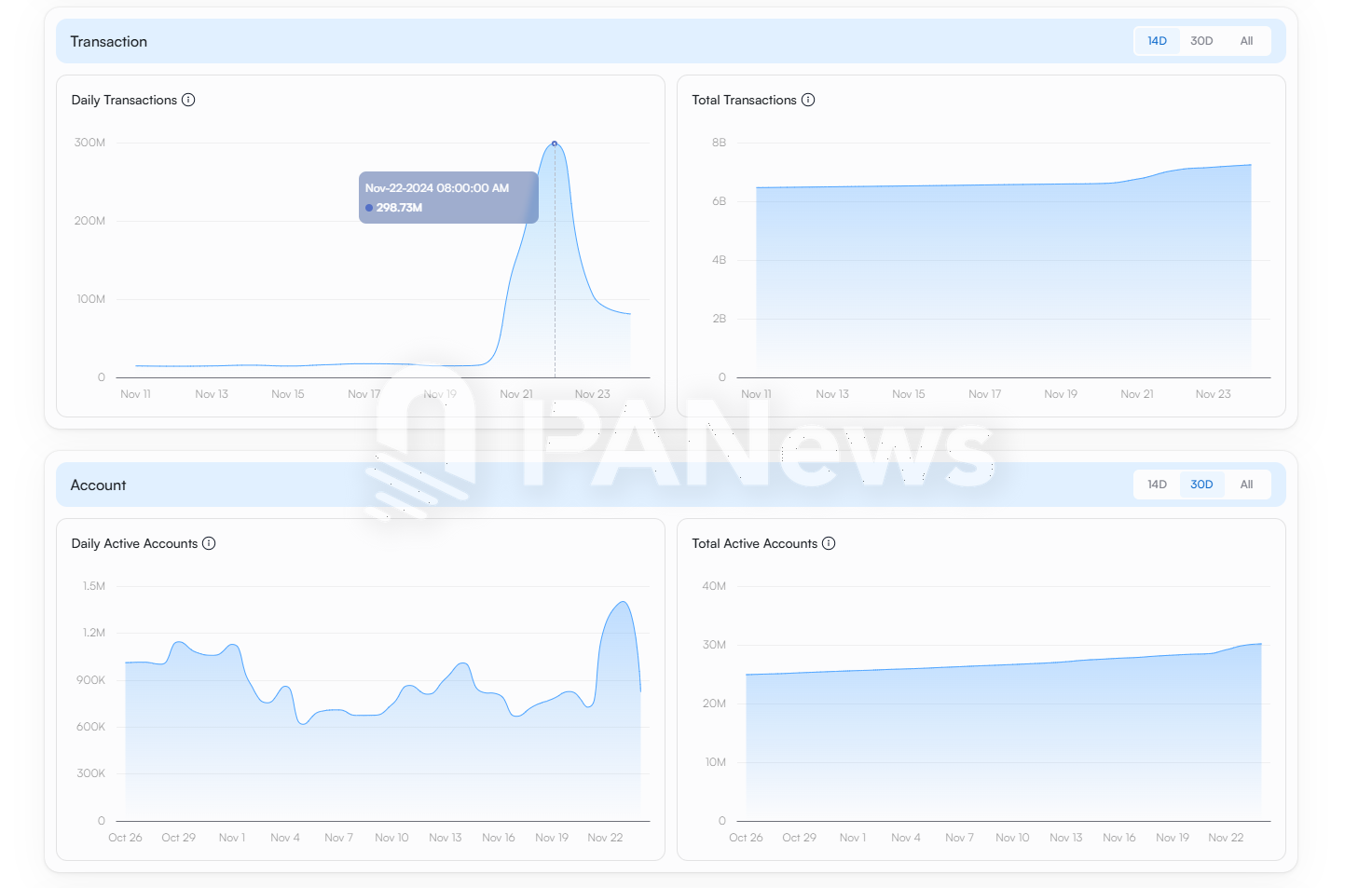

Sui seems to be able to keep up with Solana in terms of growth. The number of daily active addresses was 617,000 on November 5, and exceeded 1.4 million on November 23, an increase of more than 1 times. It is unknown whether the Sui network has once again encountered a spam attack. On November 22, the number of network transactions exceeded 298 million, and it also caused a brief network outage. This data is not only 20 times higher than the previous daily average of 15 million, but also broke the record for the number of transactions in a single day on all blockchain networks. However, this sudden surge in data has occurred on Sui several times, so the crypto community does not seem to be too surprised by this.

At present, this on-chain data blowout phenomenon is mainly caused by the popularity of Solana's MEME coin. However, this wave of enthusiasm has begun to cool down in recent days. Since November 21, the active data on the Solana chain has begun to decline, and the number of active wallets has basically returned to the level before the surge. The number of newly created tokens per day is still maintained at an average of about 60,000 per day, while the number of newly created accounts has declined significantly. This also shows that although the amount of tokens issued every day is still not small, the number of holders of each token has decreased significantly.

For MEME players who are keen on PVP, it may be a wise choice to pay more attention to some on-chain macro data and adjust their positions.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High