2026-03-07 Saturday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

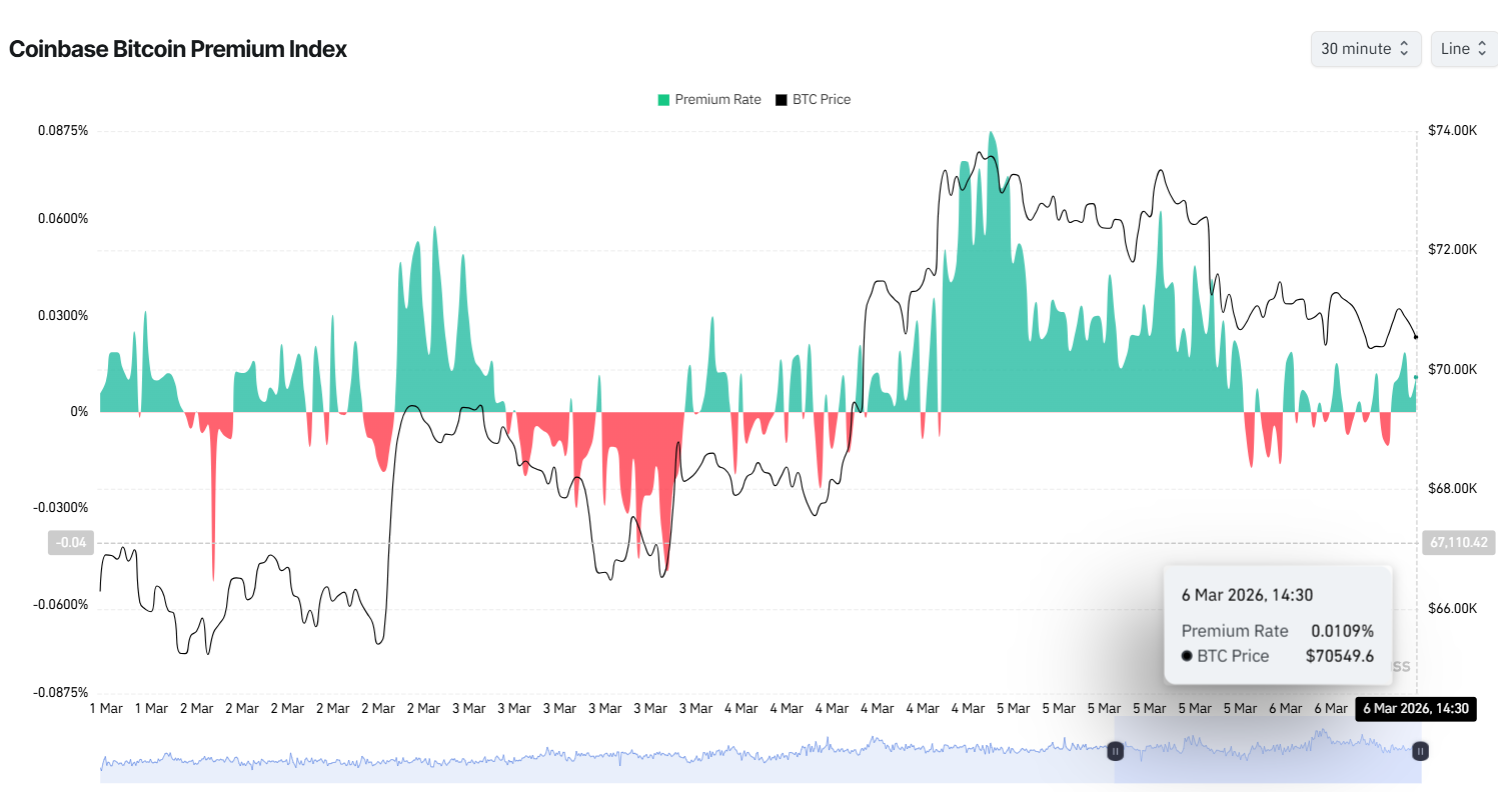

Bitcoin Falls Below $70K as Short-Term Sell Pressure Mounts, Is Capitulation Imminent?

The post Bitcoin Falls Below $70K as Short-Term Sell Pressure Mounts, Is Capitulation Imminent? appeared first on Coinpedia Fintech News Following a three-day streak

Share

Author: CoinPedia2026/03/07 06:35

Bitcoin Price News: BlackRock IBIT Records $322 Million in Inflows as BTC Recovers Toward $70K and Smart Presale Capital Flows Into Pepeto

Bitcoin price news this week is surprisingly bullish. BlackRock’s IBIT recorded $322 million in single session inflows as Bitcoin clawed its way back toward $70

Share

Author: Techbullion2026/03/07 06:25

Hacker Steals $2.7M From Solv’s Bitcoin Yield Platform

The post Hacker Steals $2.7M From Solv’s Bitcoin Yield Platform appeared on BitcoinEthereumNews.com. Crypto security researchers say the hacker exploited a bug

Share

Author: BitcoinEthereumNews2026/03/07 05:52

Bitcoin Falls Below $70K Amid Rising Oil and Market Pressure

The post Bitcoin Falls Below $70K Amid Rising Oil and Market Pressure appeared on BitcoinEthereumNews.com. Key Insights: BTC falls below $70K after facing resistance

Share

Author: BitcoinEthereumNews2026/03/07 05:47

Bitcoin ETFs Post $227.83M Net Outflows, Weekly Net Inflows At $917.28M

Key Insights: Bitcoin spot exchange-traded funds (ETFs) reported net outflows of $227.83 million on Thursday. At the same time, the BTC price held its own below

Share

Author: Themarketperiodical2026/03/07 05:28

BTC suffers late-week $110 billion wipeout as Iran trumps positive developments

The post BTC suffers late-week $110 billion wipeout as Iran trumps positive developments appeared on BitcoinEthereumNews.com. Bitcoin briefly pushed toward $74,

Share

Author: BitcoinEthereumNews2026/03/07 05:09

NYSE Backs OKX, Kraken Gets Fed Access, BTC Sells

The post NYSE Backs OKX, Kraken Gets Fed Access, BTC Sells appeared on BitcoinEthereumNews.com. Key Insights: ICE invests in OKX at $25B valuation, expanding ties

Share

Author: BitcoinEthereumNews2026/03/07 04:57

Cardano Price Prediction: ADA Drops, BTC Miners Start Selling, All While DeepSnitch AI Raises $1.9M+ Ahead of the March 31 Launch

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Share

Author: Blockchainreporter2026/03/07 04:50