DEX

Share

DEXs are peer-to-peer marketplaces where users trade cryptocurrencies directly from their wallets via Automated Market Makers (AMM) or on-chain order books. By removing central authorities, DEXs like Uniswap and Raydium prioritize privacy and user sovereignty. The 2026 DEX landscape is dominated by intent-based trading, MEV protection, and cross-chain liquidity aggregation. Follow this tag for the latest in on-chain trading volume, liquidity pools, and the technology behind permissionless swaps.

34860 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Trump’s 'desperate' push to rename landmarks for himself is a 'growing problem': analysis

2026/02/07 05:30

Volatility to stay high on flows – MUFG

2026/02/07 05:29

US Stocks Close Higher in Stunning Rally: Major Indices Surge Over 1.9%

2026/02/07 05:25

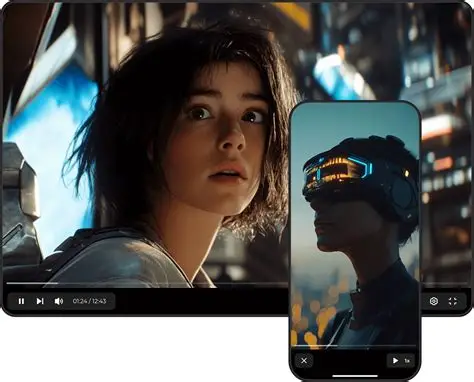

Viyou.ai: Create Stunning AI Videos, Images, and Viral Content with Unlimited Freedom

2026/02/07 05:14

XRP Price Prediction: XRP Holds $1.25–$1.35 Demand While $2.00 Reclaim Remains the Trend Trigger

2026/02/07 04:10