ETF

Share

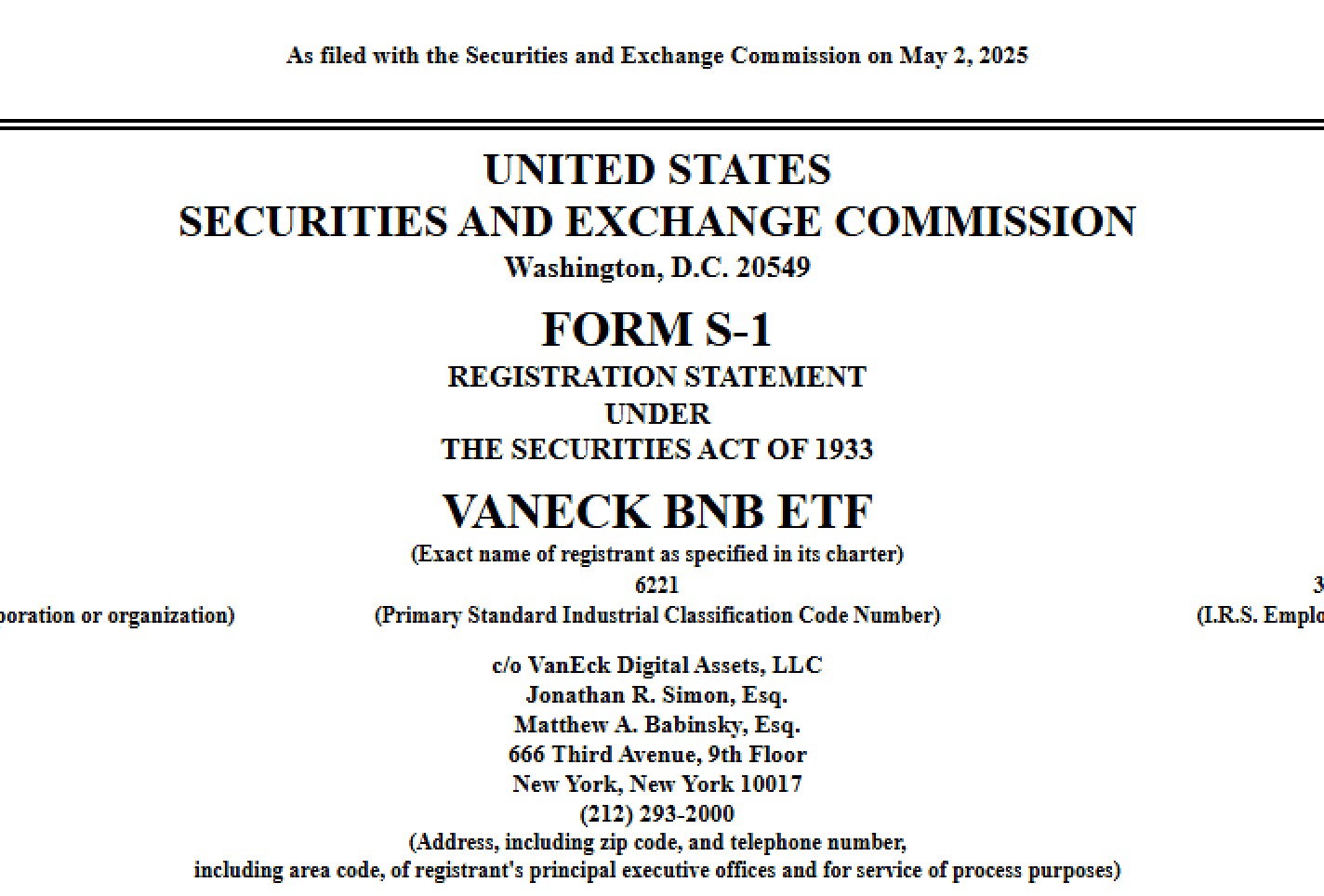

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

40177 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

What is Beste IPTV Nederland? The 2026 Guide to Dutch Trends

2026/02/08 05:10

Vitalik Buterin Highlights Crypto Privacy with Key Zcash Donation

2026/02/08 05:08

Expert Believes Upcoming Development Could Send XRP to the Moon

2026/02/08 05:05

Top Crypto Presales February 2026: DeepSnitch AI, Bitcoin Hyper, and IPO Genie Lead the Pack

2026/02/08 05:01

Famed Epstein reporter drops bombshell about '11 men' in the files: 'Trump is on the list'

2026/02/08 04:50