ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39983 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

![[LIVE] Crypto News Today: Latest Updates for August 26, 2025 – $940M in Crypto Liquidated as Bitcoin Drops Below $110K Amid Macro Pressures](https://cimg.co/p/assets/empty-cryptonews.jpg)

Recommended by active authors

Latest Articles

Trump’s 'desperate' push to rename landmarks for himself is a 'growing problem': analysis

2026/02/07 05:30

Volatility to stay high on flows – MUFG

2026/02/07 05:29

US Stocks Close Higher in Stunning Rally: Major Indices Surge Over 1.9%

2026/02/07 05:25

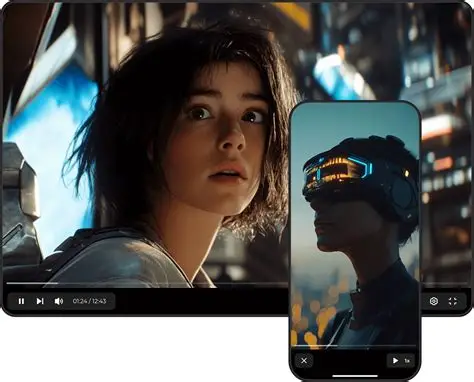

Viyou.ai: Create Stunning AI Videos, Images, and Viral Content with Unlimited Freedom

2026/02/07 05:14

XRP Price Prediction: XRP Holds $1.25–$1.35 Demand While $2.00 Reclaim Remains the Trend Trigger

2026/02/07 04:10