Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

14957 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Trump's boast backfires as medical expert points out mental and physical side effects

2026/02/06 23:37

Strategy CEO Phong Le: Bitcoin Must Hit $8,000 for Debt Risk

2026/02/06 23:05

XRP Proponent Says “It’s Done”. Here’s why

2026/02/06 23:05

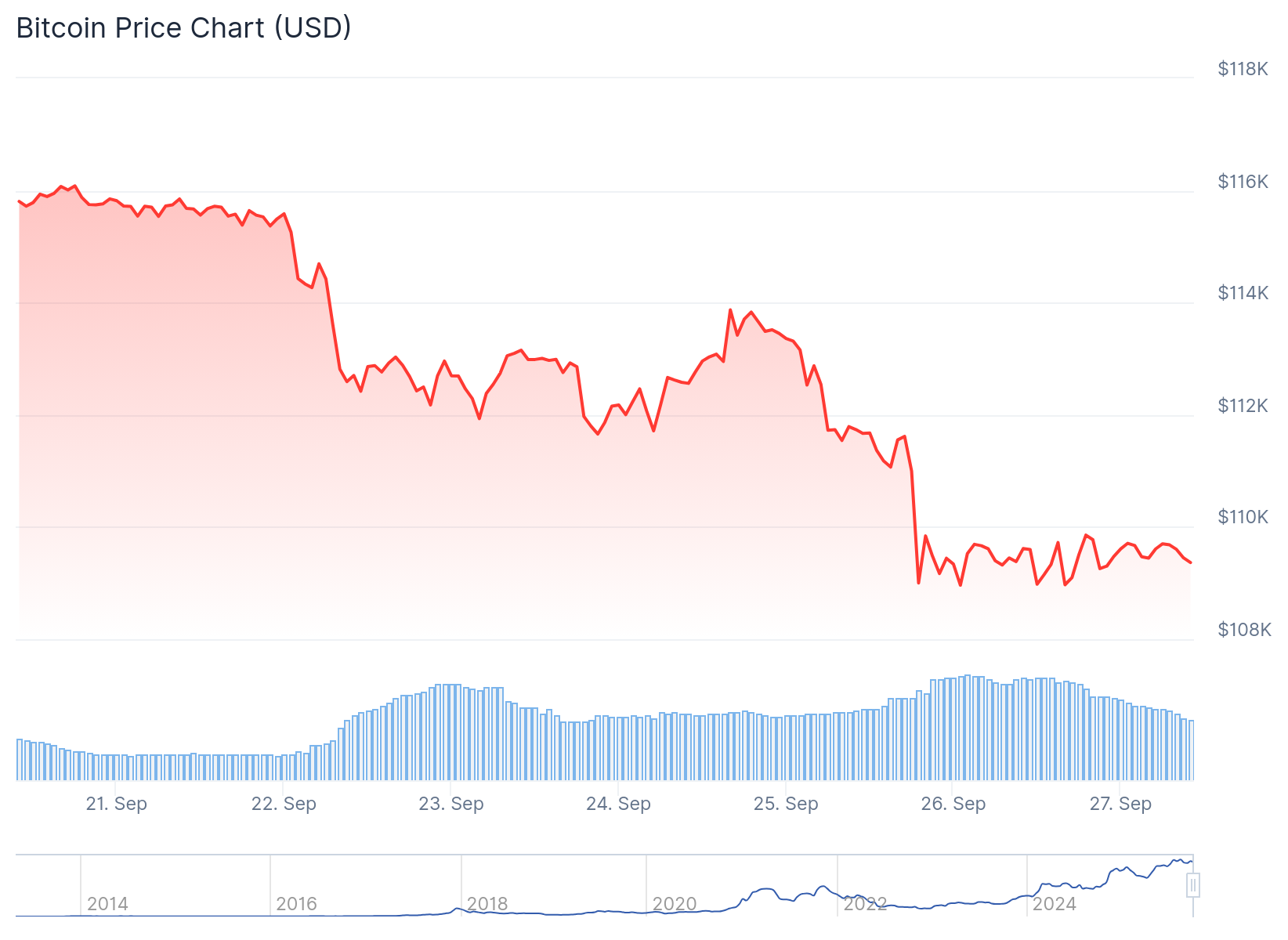

‘Only 6.6% down’: Are Bitcoin ETFs under stress amid price crash?

2026/02/06 22:48

XRP Price Prediction Update: Can XRP Rally as Analysts Eye the Next Big Crypto?

2026/02/06 22:45