NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

13249 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

NFTs in 2025 – More Than Digital Art

Author: Coinstats

2025/11/27

Share

Recommended by active authors

Latest Articles

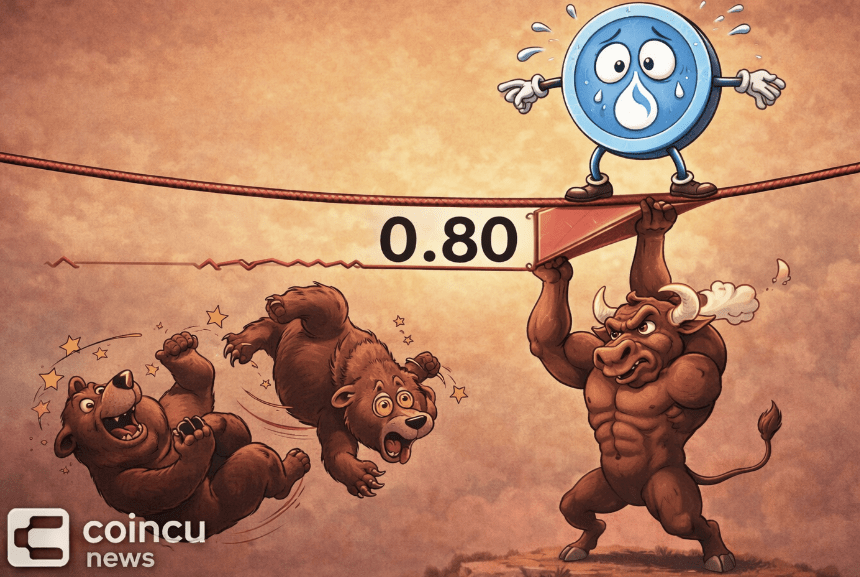

SUI price holds above $0.80 signaling possible continuation of upward momentum

2026/02/19 08:26

Stani Kulechov: Aave’s token-centric model enhances value capture, V4 introduces a hub and spoke architecture, and DAOs boost governance resilience

2026/02/19 08:20

“Milder” Bitcoin Downturn Will be Over Soon, Says Michael Saylor

2026/02/19 07:56

‘Bad news for bulls’ – Is Bitcoin’s bear market far from over?

2026/02/19 07:49

flatexDEGIRO Announces Major Dividend Increase and Strong 2025 Results

2026/02/19 07:21