NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

13129 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Smart Money Bets on Bitcoin Hyper

Author: BitcoinEthereumNews

2025/10/22

Share

Recommended by active authors

Latest Articles

USDDD Listed on CoinMarketCap as DIGDUG.DO Signals Acceleration Toward Ecosystem Expansion

2026/02/17 15:37

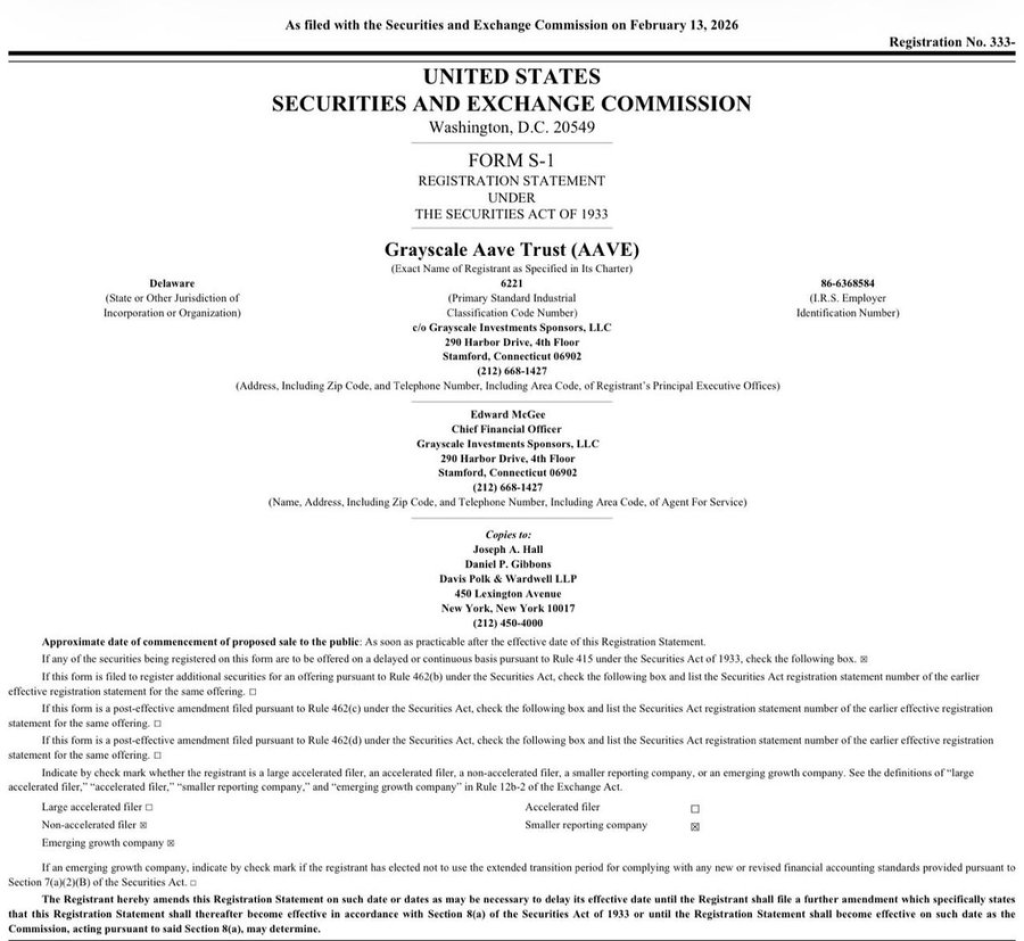

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

2026/02/17 15:30

The Evolution of his Technique: How David Segal Adapts the Drumstick Grip and Setup

2026/02/17 15:21

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More

2026/02/17 15:20

Will HBAR’s Remarkable Technology Propel It To $0.5?

2026/02/17 14:47