RWA

Share

RWA (Real World Assets) refers to the tokenization of tangible assets—such as real estate, private credit, and government bonds—on the blockchain. By bringing traditional financial instruments on-chain, RWA protocols like Ondo and Centrifuge provide DeFi users with stable, real-yield opportunities. In 2026, the RWA sector is a multi-trillion-dollar bridge between TradFi and DeFi, enabling fractional ownership and global liquidity for previously illiquid assets. Follow this tag for insights into on-chain credit markets, regulatory compliance, and asset-backed security innovations.

48558 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

ETH Technical Analysis Feb 18

2026/02/18 11:37

Strategic Pause For Crucial Mainnet Evolution

2026/02/18 11:34

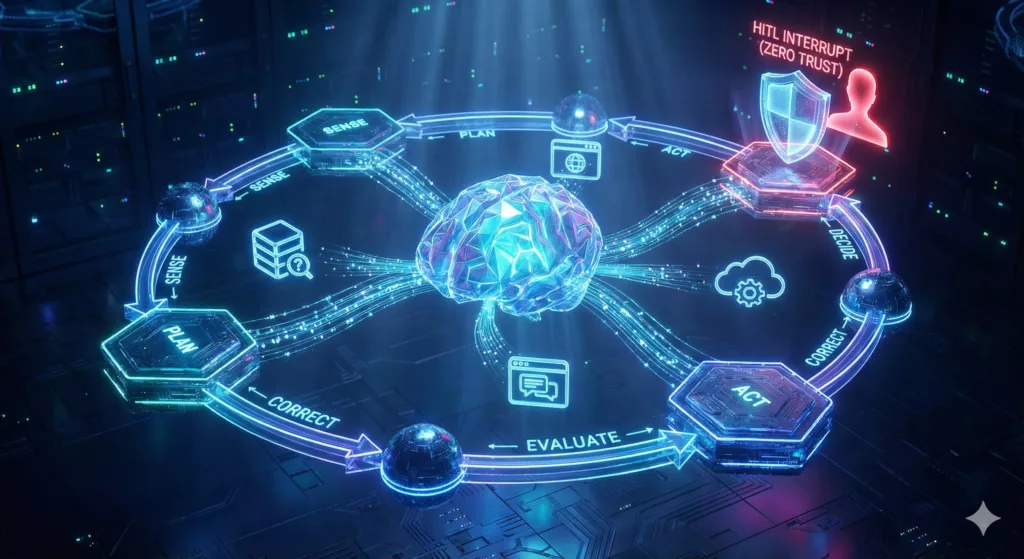

Understanding The Key to Building Your First Agent: Connecting LLMs to APIs

2026/02/18 11:33

UK Financial Ltd Announces the First Living Canine Deployed as an On-Chain Digital Asset

2026/02/18 11:31

Onchain Gold and RWA Projects Withstand Market Pullback with Solid TVL Growth

2026/02/18 11:00