Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

16179 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

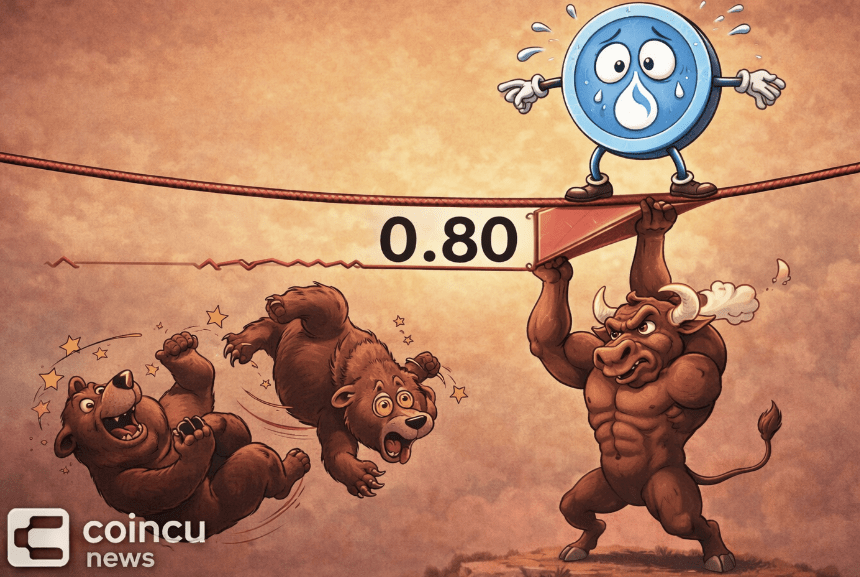

SUI price holds above $0.80 signaling possible continuation of upward momentum

2026/02/19 08:26

Stani Kulechov: Aave’s token-centric model enhances value capture, V4 introduces a hub and spoke architecture, and DAOs boost governance resilience

2026/02/19 08:20

“Milder” Bitcoin Downturn Will be Over Soon, Says Michael Saylor

2026/02/19 07:56

‘Bad news for bulls’ – Is Bitcoin’s bear market far from over?

2026/02/19 07:49

flatexDEGIRO Announces Major Dividend Increase and Strong 2025 Results

2026/02/19 07:21